oregon tax payment deadline

This deadline is specific to this year because April 15 the usual deadline is a holiday in the District of Columbia. The tax is computed as 250 plus 057 percent of taxable Oregon commercial activity of more than 1 million.

Blog Oregon Restaurant Lodging Association

7192022 Aug 3 2022 Tax Practitioners Board Meeting.

. Nov 30 Tax Bills Due Deadline for 4 discount. The CAT is applied to taxable Oregon commercial activity in excess of 1 million. If youre been missing payment deadlines its surprisingly complicated to figure out how much penalty you owe.

Form SSA-1099 - Dependents. Real Estate Tax Bill Payment Information. Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct payments to taxpayers an expansion of jobless benefits funding for state and local governments and an expansion of vaccinations and virus-testing programs.

912022 Estimated payment deadline coming up. Nov 01 Tax Bills Issued Inventory exempt. Individual Income Tax Return electronically using available tax software products.

Additional time commitments outside of class including homework will vary by student. IRA or Roth IRA - Excess Contributions. NOVEMBER 30 2022- 1st HALF-PAYMENT due.

2022-23 annual premium. The practical effect of the tax is to tax income of certain City residents within a certain income range and is therefore not a poll or head tax On June 8 2016 the Oregon Court of Appeals affirmed the decision of the Multnomah County Circuit Court. Additionally Tax Year 2021 Form 1040-NR Amended and Tax Year 2021 Form 1040-SSPR Corrected returns can now be filed electronically.

Postmarked transmitted by private express carrier or paid online via the Douglas County website on or before a due date will be considered timely. IRS Forms Not Yet Released. JANUARY 31 2023- Last day to pay 2022 tax bill without penalty and interest.

The deadline for 2021 individual tax returns is April 18 2022 for all states except Maine and Massachusetts. Willfully attempted to evade tax. The Income Tax Course consists of 62 hours of instruction at the federal level 68 hours of instruction in Maryland 80 hours of instruction in California and 81 hours of instruction in Oregon.

Filing_upsell_block Finding out how much penalty you owe. IRS Form 9465 - Installment Agreement Request - TaxAct. Not only will there be no time limit on IRS action against tax fraud or tax evasion but there may be increased interest fees and penalties.

Based on 30 days from notice or tax bill date. 25000 base value exemption. If an active lawsuit exists for a previous year attorney fees are added to the 2022 tax bill on February 1 2023 MARCH 31 2023- Last day to pay 2022 business personal property taxes without accruing attorney fees.

False or fraudulent filing or tax evasion involves willfully filing false tax information failing to file or attempting to evade taxes. In cases where a federal income tax return was not filed the law provides most taxpayers with a three-year window of opportunity to claim a tax refund. 25 penalty for late filing.

752022 IRS Newsletter July 2022. Deadlines for Mailing your Tax Returns in 2022. If you need to amend your 2019 2020 and 2021 Forms 1040 or 1040-SR you can now file the Form 1040-X Amended US.

Check out our new and improved tax calendar so you dont miss key property tax notices and dates. For 2016 tax returns the window closes July 15 2020 for most taxpayers. Taxpayers who are under the age of 18 are exempt from the tax.

912022 IRS News for Tax Practitioners Sept 2022. Tax Bills Due Deadline for 2 discount. Glenn Curtis has 12 years of work experience in strategic and market research as well as 7 years as an equity analyst finance manager and writer.

6102022 Mileage Rate Increase. If they do not file a tax return within three years the money becomes the property of the US. But you will need to pay tax for the extra 25000 as a lump sum on April 15.

752022 City of Portland Business License Law Proposed Code Changes. To receive a discount and avoid interest charges tax payments MUST be made timelyDue dates are November 15 2021 February 15 2022 and May 16 2022. Mar 31 Tax Bills Due.

Mandatory State Disability and Unemployment Insurance Contributions. You can make your quarterly tax payments based on the 75000 and you wont be penalized for it. Dec 31 Tax Bills Due.

Failed to file a return. Capital Gains and Losses - Transaction Adjustment Codes. 832022 IRS News for Tax Practitioners August 2022.

Apr 01 PP Returns Due Inventory. A tax deadline extension is an automatic 6-month extension that gives you more time to file your taxes if youre unable to meet the typically mid-April deadline. For more information please visit our.

Filing a Federal Individual Tax Return Extension - Form 4868. This includes payment of your 2021 tax liability. The 2021 tax deadline to file City of Oregon returns is April 18 2022.

Register for the Corporate Activity Tax. For 2022 the tax deadline for individuals was on April 18th and for 2023 the date falls on April 17th. Only taxpayers with more than 1 million of taxable Oregon commercial activity will have a payment obligation.

3078 paid as 1026 per term or 1539 per semester This breaks down to 25650 per month when comparing to other plans. You can file Form 4868 before the deadline to receive the automatic. Feb 28 Tax Bills Due Deadline for 1 discount.

Payment of any estimated tax due should be sent in by the original due date of the return to avoid a late payment penalty. For most 3rd class counties. Although not required by state law a courtesy copy of the extension by the due date of the.

Typically 30 Days from the first tax payment due date. State restrictions may apply. Tax payments delivered US.

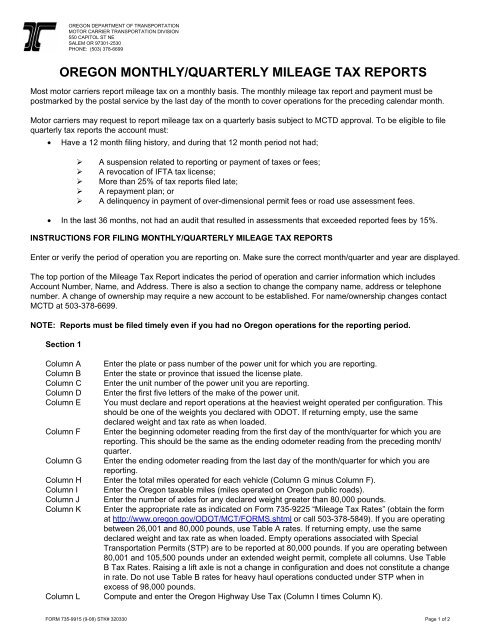

Oregon Monthly Quarterly Mileage Tax Reports Oregon Department

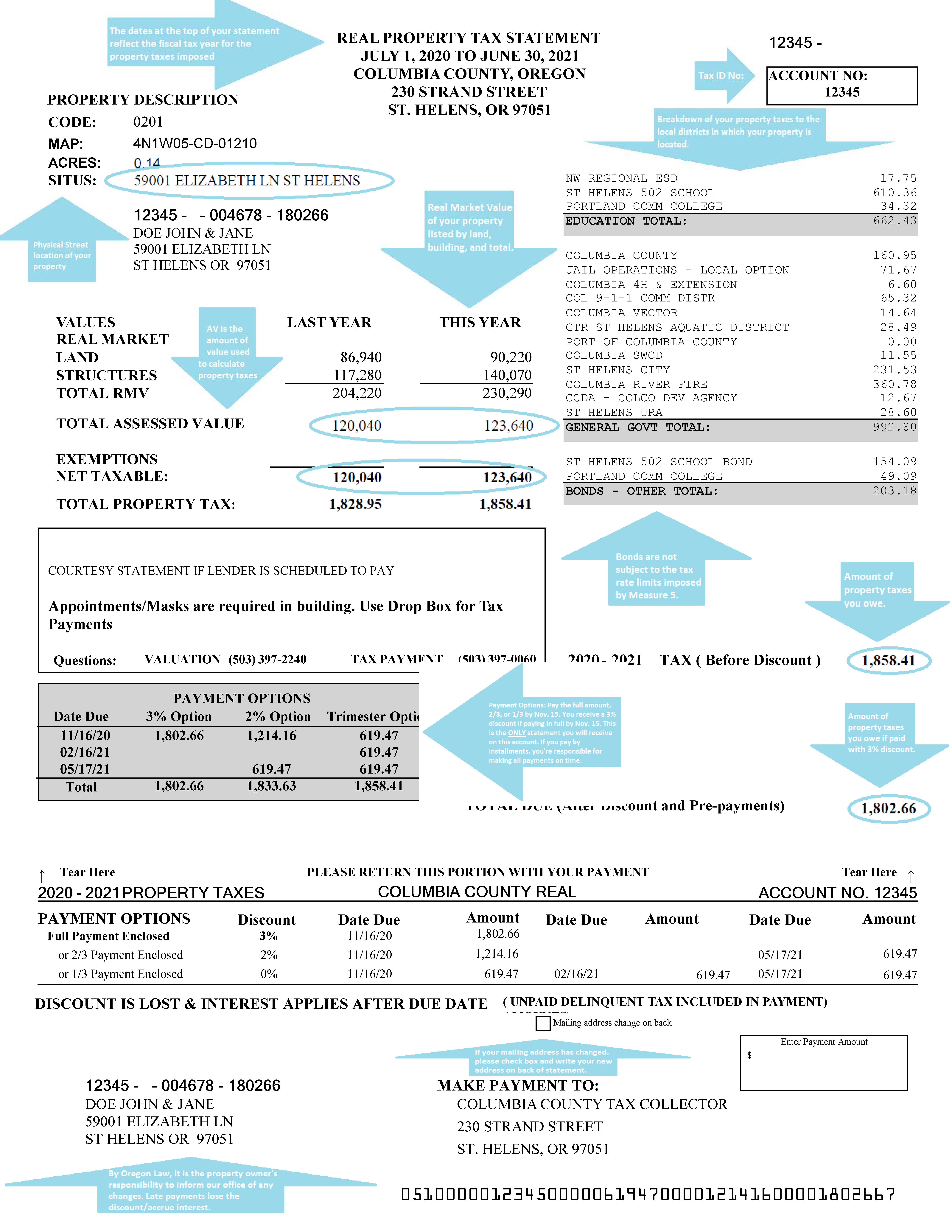

Columbia County Oregon Official Website Tax Office

Columbia County Oregon Official Website Understanding Your Property Tax Statement

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

E File Oregon Taxes For A Fast Tax Refund E File Com

Oregon State Tax Software Preparation And E File On Freetaxusa

Understanding Your Property Tax Bill Clackamas County

.png)

Columbia County Oregon Official Website Understanding Your Property Tax Statement

Oregon State Tax Information Support